Decaf Coffee Survey Results Part I

Key Findings on Consumption Patterns and Preferences

Executive Summary

This report, the first of a two-part series, presents findings from a survey of 356 coffee enthusiasts, focusing on decaffeinated coffee consumption trends, preferences, and market opportunities. Key insights include:

A growing interest in decaf among younger demographics, challenging traditional perceptions.

Strong demand for higher quality and more diverse decaf options, particularly in flavour profiles.

Health and lifestyle considerations as primary motivators for decaf consumption.

A preference for specialty coffee channels and sophisticated brewing methods among decaf consumers.

Opportunities for consumer education on processing methods and decaffeination techniques.

This part of the report focuses on demographic data, consumption patterns, motivations, and general preferences. Part 2 will include comparative analyses, open-ended responses, and deeper insights into decaf consumer behaviour.

Introduction

The decaffeinated coffee market has long been considered a niche segment and an afterthought, often overlooked in favour of its caffeinated counterpart. However, recent trends suggest a shift in consumer attitudes and behaviours towards decaf coffee. This study aims to investigate current trends in decaf coffee consumption, challenging long-held assumptions and revealing new opportunities for the coffee industry.

Through a survey of 355 coffee enthusiasts across 34 countries, we've gathered data on demographics, consumption patterns, preferences, and motivations of decaf coffee drinkers. The survey was shared in various coffee focused channels (online and offline) including a wide range of participants.

Demographics

The demographic data reveals several surprising insights about decaf coffee consumers. Contrary to the common perception that decaf is primarily consumed by older individuals, our survey shows a significant skew towards younger age groups, with over 70% of respondents being under 45 years old. This suggests a growing interest in decaf among millennials and younger Gen X consumers, possibly driven by increasing health consciousness and changing lifestyle preferences.

Overall, we had respondents from 34 countries and the majority were from North America (40.5%), the United Kingdom (19.9%), Germany (6.3%), Canada (4..2%), and the Netherlands (3.3%).

The gender distribution shows a significant male majority among decaf consumers (70.4% compared to 22.4% female). This challenges the stereotype that decaf is primarily a female-driven market and suggests that marketing strategies for decaf coffee may need to be reconsidered to target a broader audience.

Consumption Patterns

The consumption patterns reveal that decaf coffee is not just an occasional choice for most consumers. Over 66% of respondents drink decaf at least several times a week, with nearly 40% consuming it daily or multiple times a day. This high frequency of consumption suggests that decaf has become a staple in many consumers' diets, rather than just an alternative option.

A small percentage of respondents (6.8%) never consume decaf. Among those who don't drink decaf, the need for a caffeine boost is the primary reason, followed by flavour concerns. This highlights two key areas for the decaf industry to address: educating consumers about alternative energy sources and significantly improving the flavour profile of decaf offerings.

The data on duration of decaf consumption is particularly telling. Over 53% of respondents have been drinking decaf for 3 years or less, indicating a recent surge in popularity. This trend aligns with the younger demographic profile we observed earlier and suggests that the decaf market is in a growth phase.

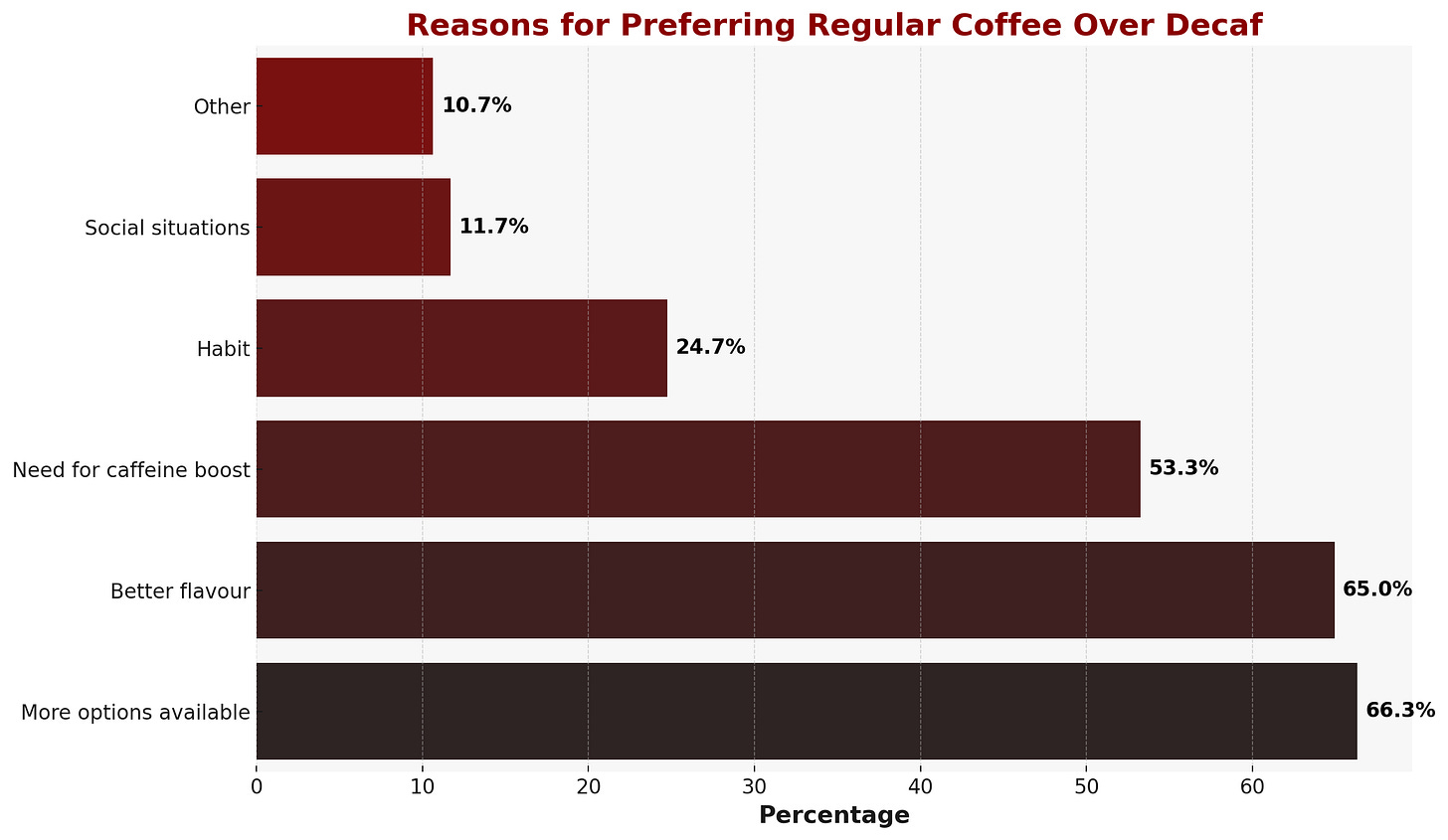

Only 11.8% of the participants were decaf only consumers. The majority of the respondents also consume regular (caffeinated coffee) regularly (75.5%), while other consumer regular coffee occasionally (12.7%). When asked to compare the regular to their decaf coffee consumption the overwhelming majority (65.1%) drink more regular coffee than decaf, while 20.6% drink more decaf. The main reasons participants prefer regular to decaf were the amount of options available when choosing regular coffee (66.3%), the flavour (65%), and the need for caffeine boost (53.3%).

Motivations and Preferences

The motivations for choosing decaf reveal that consumers are primarily driven by lifestyle and health considerations. The overwhelming majority (78%) choose decaf to avoid sleep disruption, indicating that many consumers are becoming more conscious of their caffeine intake and its effects on sleep quality, while others are drinking decaf to gradually reduce their caffeine intake (16.9%). The second most popular category is health concerns and caffeine sensitivity (47.4%). This presents an opportunity for decaf brands to position their products as part of a healthy sleep routine and an alternative to caffeinated drinks.

The preferences regarding caffeine content are particularly interesting. A significant portion (41.7%) of respondents are willing to accept some caffeine for better flavour, suggesting that taste is a crucial factor for decaf drinkers. This indicates that there might be a market for "low-caf" options that offer a balance between reduced caffeine content and superior taste. Only 12.1% of the respondents prefer decaf with the lowest caffeine content.

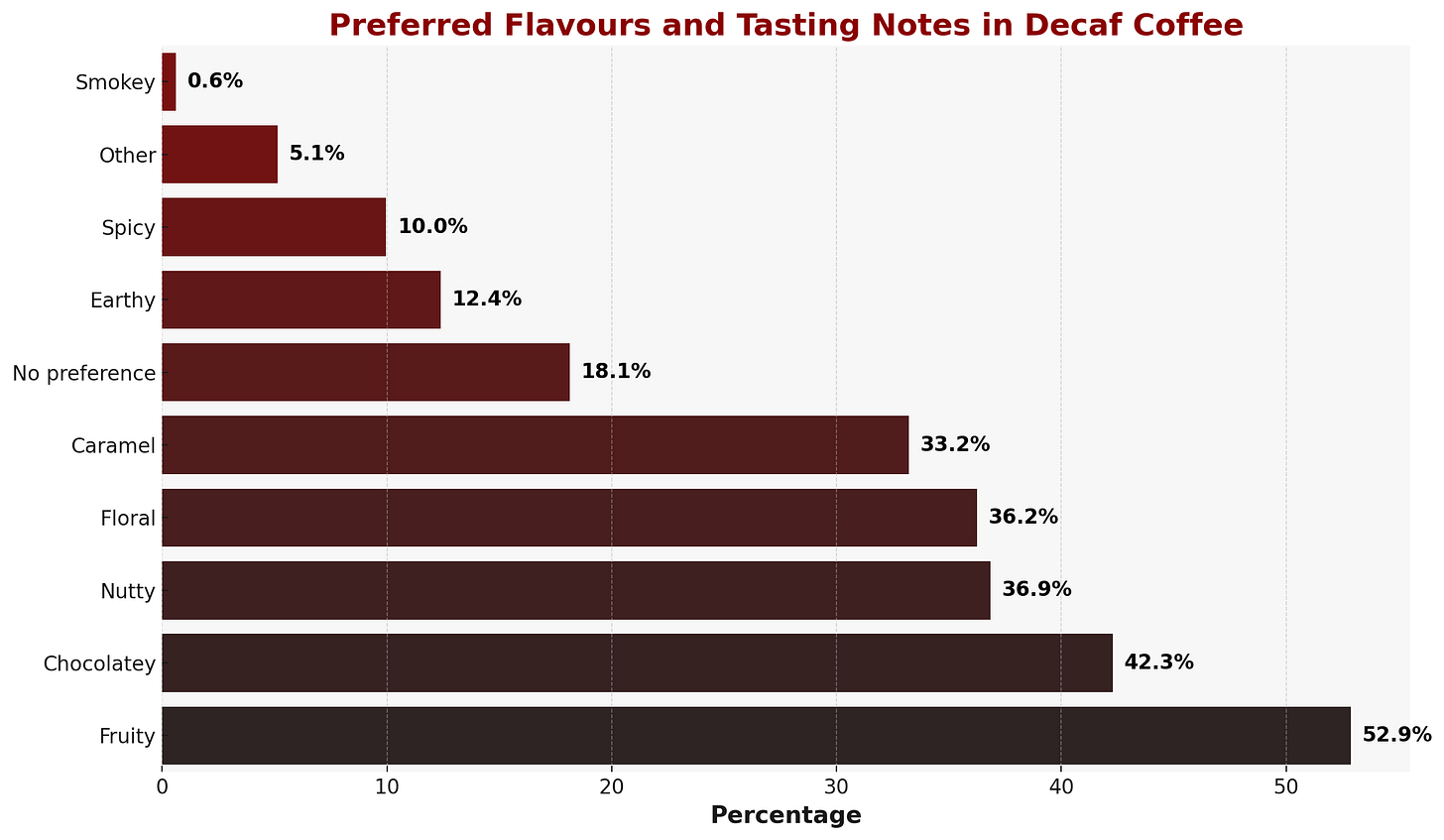

The flavour preferences show a surprising lean towards fruity notes (52.9%), followed closely by chocolatey (42.3%), nutty (36.9%), and floral (36.2%) profiles.

When asked about preferred roast levels, most participants reported preferring Light-Medium (47.1%), Medium (43.2%), and Light (37.8%) levels. Only 8.8% had a preference for Dark roasts. This challenges the traditional perception of decaf as primarily catering to those who prefer darker, more roasted flavours. It suggests that there's a demand for more complex and diverse flavour profiles in decaf coffee, similar to what's available in regular coffee.

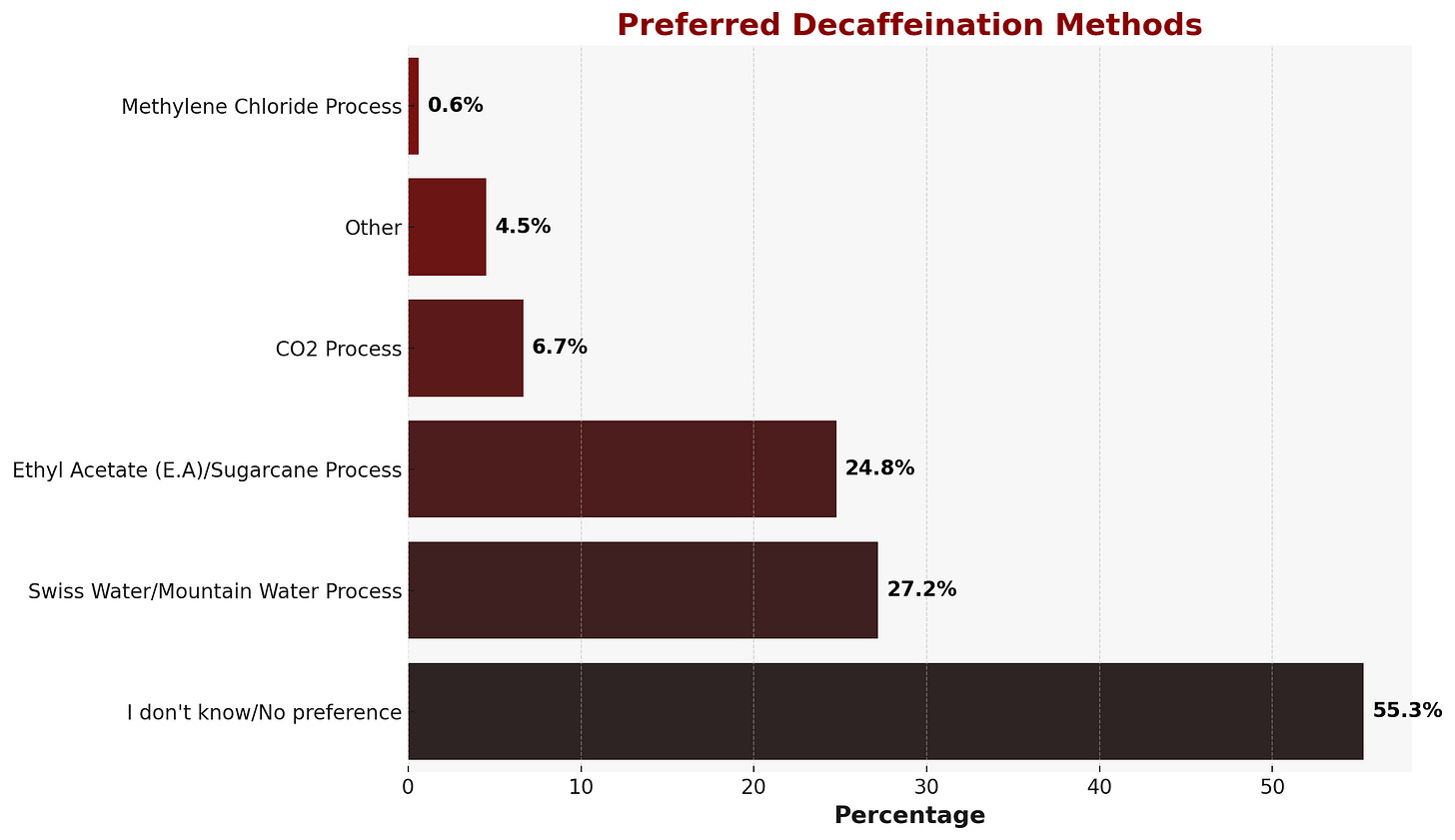

The data on processing and decaffeination method preferences reveals a significant knowledge gap among consumers. A large percentage either don't know or have no preference regarding these aspects. This presents an opportunity for education and marketing efforts to inform consumers about different processing methods and their impact on flavour. It is also worth noting that several consumers with knowledge appear to show interest in a variety of methods beyond washed including natural, honey process, anaerobic fermentation, and experimental. This is a need not easily met by the current market offerings that often focus on washed and less complex decaf.

Finally, when asked about their preferred coffee origins, most participants don’t seem to have a preference (39.6%) followed by South America (34.1%), and Africa (23.6%). Like in the previous responses, some participants (17.5%) did not know.

Purchasing and Brewing Habits

The purchasing habits of decaf consumers reveal a strong preference for specialty coffee channels. Over 45% buy directly from roasters, and a significant portion purchase from local coffee shops and online specialty retailers. Some consumers (21.8%) reported purchasing decaf from supermarkets and 5.7% from subscription services. This suggests that the majority of decaf drinkers are seeking out high-quality, freshly roasted beans, much like their regular coffee-drinking counterparts.

The majority of respondents spend between $10 and $20 on a bag of decaf coffee. Around 20% of the participants, however, are willing to spend over $201.

The popularity of pour-over methods for brewing decaf at home (56.8%) is noteworthy. This method is often associated with specialty coffee and suggests that decaf drinkers are invested in the craft of coffee brewing. The significant use of espresso machines (36%) also indicates that many consumers are looking for decaf options for their espresso-based drinks.

The ways in which consumers discover new decaf coffees highlight the importance of both physical and digital presence for coffee brands. While in-store browsing remains the top method, the high percentage of discovery through coffee-focused websites and online reviews underscores the importance of digital marketing and maintaining a strong online presence for decaf coffee brands. Recommendations (in-person and online) also play a big role in the selection of decaf coffee.

Important Aspects of Decaf Coffee

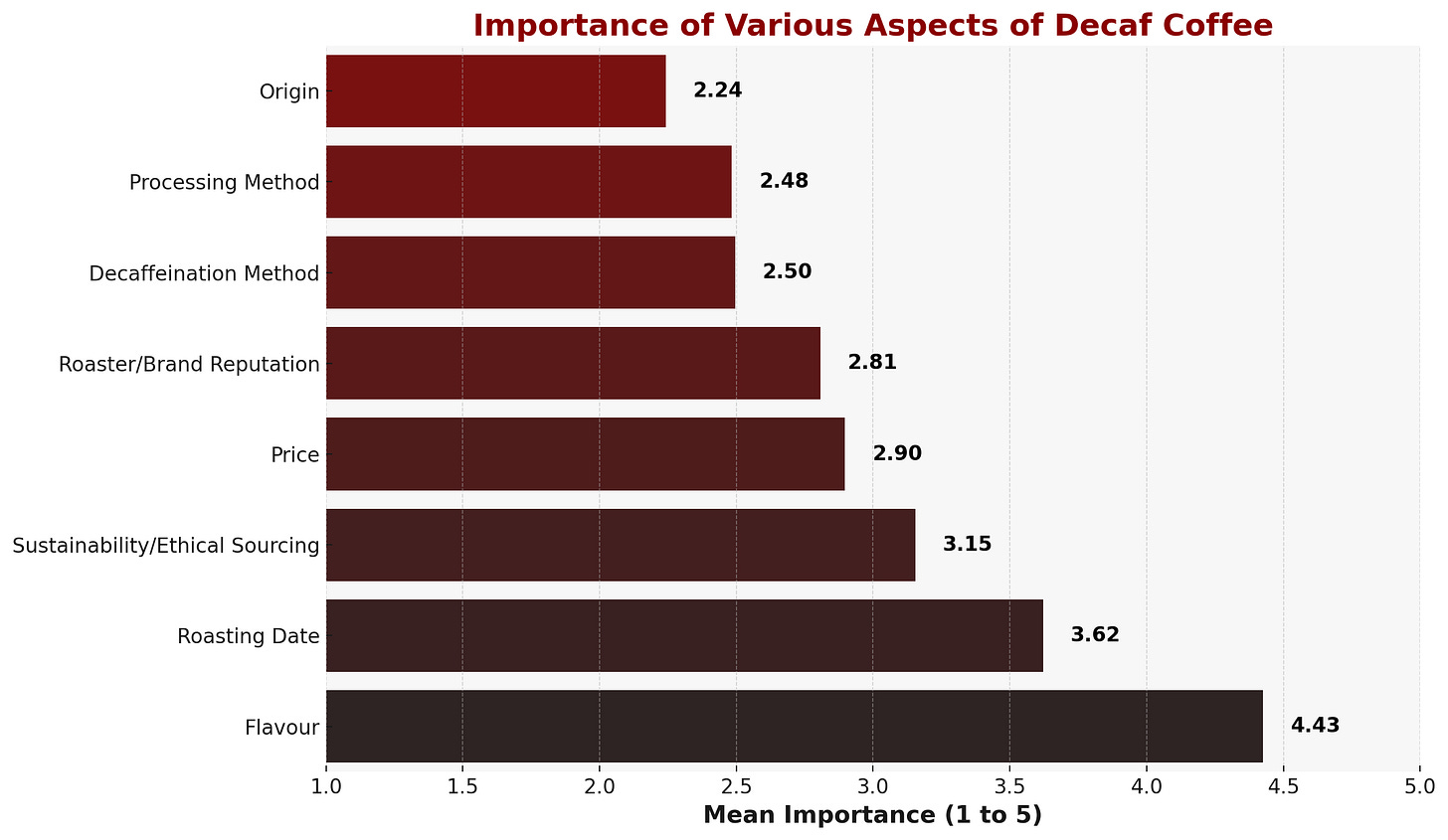

These ratings provide insights into what decaf coffee consumers value most. Flavour is the most important factor, reinforcing the earlier finding that taste is crucial for decaf drinkers. Roasting date is another aspect valued by consumers, even though it’s something often overlooked by coffee roasters. The relatively high ranking of sustainability and ethical sourcing aligns with broader trends in consumer consciousness and suggests that decaf brands should emphasise their ethical practices.

Interestingly, while decaffeination method is often a point of discussion in the coffee industry, it ranks relatively low in importance for consumers. This could be due to a lack of understanding about different methods, presenting an opportunity for consumer education.

The lower importance of origin compared to other factors is surprising, given its prominence in specialty coffee marketing. This might indicate that decaf consumers are more focused on the end result (flavour, freshness) than the specific origin of the beans.

Satisfaction and Accessibility

The satisfaction level with current decaf options indicates significant room for improvement in the market. The below moderate satisfaction score suggests that while consumers are not entirely dissatisfied, they believe there's potential for better decaf offerings.

The slightly higher score for ease of finding good quality decaf locally (3.06) is encouraging, suggesting that availability is improving. However, it also indicates that there's still work to be done in making high-quality decaf more accessible.

The self-rated coffee knowledge score (3.24) suggests that decaf consumers consider themselves reasonably knowledgeable about coffee. This aligns with earlier findings about brewing methods and purchasing habits, indicating a fairly sophisticated consumer base for decaf coffee.

Conclusion

The findings presented in this first part of our report challenge many preconceptions about decaf coffee and its consumers. Far from being a marginal product favoured by older demographics, decaf coffee is emerging as a significant market segment with a younger, more diverse consumer base than previously thought.

Key takeaways include:

Younger consumer base: With over 70% of respondents under 45, the decaf market might be younger than traditionally perceived.

Gender shift: The significant male majority among respondents suggests a need to reconsider gender-based marketing strategies for decaf coffee.

Health and lifestyle focus: The primary motivations for choosing decaf centre around sleep quality and health concerns, indicating an opportunity for wellness-focused marketing.

Flavour priority: The high importance placed on flavour, particularly fruity and complex profiles, challenges the notion that decaf drinkers settle for inferior taste.

Specialty channel preference: The tendency to purchase from roasters and specialty retailers suggests a sophisticated consumer base seeking high-quality products.

Education opportunity: The lack of knowledge about processing and decaffeination methods presents an opportunity for brands to educate and engage consumers.

These insights suggest that the decaf coffee market is dynamic, growing, and ripe with opportunities for innovation and market expansion. However, the moderate satisfaction levels indicate that there's still significant room for improvement in meeting consumer expectations.

In Part 2 of this report, we will look into comparative analyses, exploring how different decaf drinkers interact with decaf coffee. We will also analyse open-ended responses to gain richer, qualitative insights into consumer attitudes and behaviours.

Continue to Part 2:

this needs additional research as the question didn’t specify the quantity of coffee and several participants might not be used to the US dollar as currency